how to calculate sales tax in oklahoma

If you are based in Oklahoma and selling to a buyer with a ship to address in Oklahoma charge sales tax based on the sales tax rate at the ship to. Maximum Local Sales Tax.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way.

. Local tax rates in Oklahoma range from 0 to 7 making the sales tax range in Oklahoma 45 to 115. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price. If you do not.

Sales Tax Table For Tulsa County Oklahoma. All numbers are rounded in the. The average cumulative sales tax rate in Tulsa Oklahoma is 831.

The excise tax for new cars is. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. In addition to the 125 sales tax buyers are also charged a 325 excise tax on all new vehicle.

The base state sales tax rate in Oklahoma is 45. This includes the rates on the state county city and special levels. Local tax rates in Oklahoma range from 0 to 7 making the sales tax range in Oklahoma 45 to 115.

Use tax is calculated at the same rate as sales tax. Average Local State Sales Tax. Multiply the vehicle price after trade-ins and incentives.

Item or service cost x. The Oklahoma state sales tax rate is 45. If you make 70000 a year living in the region of Oklahoma USA you will be taxed 11520.

How To Calculate Oklahoma Sales Tax On A New Car. Sales Tax Table For Oklahoma. Alone that would be the 14th-lowest rate in the country.

This is the total of state and. The oklahoma city sales tax rate is 8625 taxing jurisdiction rate oklahoma state sales tax 450 oklahoma city tax 413 combined sales tax. Oklahoma Income Tax Calculator 2021.

To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. Oklahoma County Oklahoma sales tax rate details The minimum combined 2021 sales tax rate for Oklahoma County Oklahoma is 863. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 771 in Oklahoma.

Your average tax rate is 1198 and your marginal. Multiply the vehicle price by the sales. The state sales tax rate in Oklahoma is 450.

The oklahoma city sales tax rate is 8625 taxing jurisdiction rate oklahoma state sales tax 450 oklahoma city tax 413 combined sales tax. The average cumulative sales tax rate in Oklahoma City Oklahoma is 875 with a range that spans from 85 to 95. This includes the rates on the state county city and special.

To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. Maximum Possible Sales Tax. Find your Oklahoma combined.

Oklahoma State Sales Tax. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 828 in Tulsa County Oklahoma. Tulsa has parts of it located within Creek County Osage.

Oklahoma Sales Tax. Since this varies by city and county use the state sales tax rate of 45 045 plus the applicable city andor county rates. Typically the tax is determined by.

Sales tax on all vehicle purchases in Oklahomaeven used carsis 125. The excise tax for new cars is. In Oklahoma this will always be 325.

In Oklahoma this will always be 325. However in addition to that rate Oklahoma has.

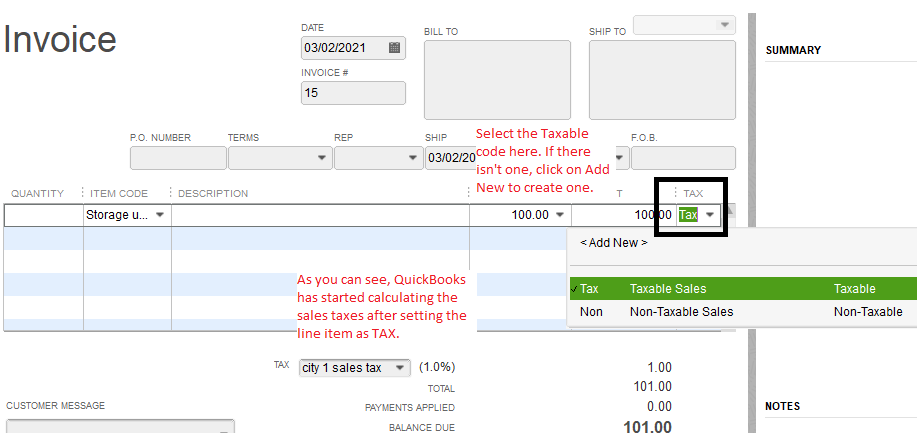

Solved How Do You Add Tax To Estimates And Invoices

How To Charge Your Customers The Correct Sales Tax Rates

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Calculate Sales Tax And Final Price Youtube

How To Calculate California Sales Tax 11 Steps With Pictures

Sales Tax Calculator And Rate Lookup Tool Avalara

Consumers Behavioral Response To Sales Taxes On Food In Kansas Document Gale Academic Onefile

Online Sales Tax Compliance Ecommerce Guide For 2022

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

How To Charge Your Customers The Correct Sales Tax Rates

How To File And Pay Sales Tax In Oklahoma Taxvalet

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Saas Sales Tax For The Us A Complete Breakdown

Sales Taxes In The United States Wikipedia

How Oklahoma Sales Tax Calculator Works Step By Step Guide 360 Taxes

Amazon Sales Tax What It Is How To Calculate Tax For Fba Sellers

Oklahoma Sales Tax Handbook 2022

Etsy Marketplace Collects Sales Tax For You Accounting For Jewelers